Perhaps this information that I’ve found will help someone out there, since OUR dad already knows everything and won’t even try to avoid foreclosure any more. My frustration level with that is quite high, as you all can imagine.

I’m not a lawyer or a financial expert in any way, so this isn’t any kind of professional advice. I’m just an artist who works in a nonprofit by day and who knows how to use Google.

I’m focusing on Washington law, because that’s where we live. Other states may have and probably do have other laws. So Google for yourself. ☺

According to Washington Law Help, a foreclosure can be started when the following has happened:

1. You’ve missed several payments

2. The mortgage holder has filed a court action in King County Superior Court (or in the county in which you live).

3. Part of the court action is that you must be served with a Summons and Complaint.

4. Or, if you have a deed of trust mortgage, the mortgage company can begin foreclosure without going to court. First, they must send you a Notice of Default.

5. Thirty days later, you will get a Notice of Trustee’s Sale and Notice of Foreclosure.

6. The house can not be sold until 190 days after your last payment. A complete foreclosure timeline is here.

There are a number of things that you can do to avoid losing your home, though. It’s not a lost cause. Remember the end of The Brady Bunch Movie? You never know when the perfect opportunity to save the day might come along. Keep your eyes open for metaphorical musical talent contests.

1. Contact the lender and ask, for payment arrangements.

First, talking to the mortgage company can’t hurt, and many times it can help. They don’t really want your house¬—they want their money. Sometimes, they’ll work out a deal with you before you’re too far behind. If you’re temporarily out of work, or are faced with an unexpected emergency, they might agree right there to let you get caught up on your payments over time. Get any agreements you make in writing, and try not to let them stress you out. Creditors have tricks to panic you into promising things that you know you can’t deliver, and then they’ll act surprised when you aren’t able to send them thousands of dollars within a few days. Honesty is the best policy here.

That’s not to say that you have to talk to them if you’re not ready, or if you feel like they are harassing you. A law that a lot of people don’t know about prohibits them from harassing you, calling you many times a day, or threatening you. You could not answer the phone, of course. But you can also tell them to stop calling you, and they have to stop. HUD doesn't recommend doing this, they say to keep communication open. (Whatever you decide to do, make a note of the date and time, and anything else you know—like the name of the person you talked to, whenever you talk to them. In times of stress, memory suffers, and you may need to refer to your notes later.

Some magic words to ask for are: forbearance and/or deferral, which would allow you to make reduced or no payments for a certain amount of time Ask for the Loss Mitigation department when you call.

2. Pay a little extra each month until you’re caught up. They call this Loan Reinstatement. You’ll likely need to agree to be caught up by a certain date.

3. Ask for Loan Modification. They may be willing to change the terms of your loan so you can afford payments, such as stretching out the term of the loan or adjusting the interest rate.

4. Refinance. Call your lender, or talk to other lenders. If you have decent credit, you’ll have them jumping up and down to help you refinance.

5. Deed house back to lender. I’ll be honest and say I don’t understand this idea.

6. Sell house yourself before foreclosure. You can probably get more by selling your house yourself. Have you ever watched late night TV, and seen those commercials about buying foreclosed homes for pennies on the dollar? That could be your house sold for a bargain, and if it doesn’t cover the cost of your outstanding mortgage, you could end up still owing money for a house that you don’t even live in anymore!

7. Make payments any time up until 11 days before the foreclosure sale.

8. You may be able to buy your house back from the sheriff at the foreclosure sale. If you have the money. Or get it back after the foreclosure sale, even.

9. File bankruptcy. You’ll probably still lose your home, though.

10. Get government help. Hopefully there will be more such help soon. (Go Obama!)

There are people out there who will help. It’s OK to ask family and friends, in fact, they may be waiting for you to ask them and let them know what they can do to help you out. Other places to turn:

In King County, call 211 for referrals to organizations that can help.

Solid Ground Home Stability Program 206-461-3200, another place dad refuses to call.

Washington Homeownership Center is a free information and referral service for homebuyers. Call their Homeownership Hotline for assistance: 1-877-894-HOME (4663), alas, assistance is not something our dad will admit to needing.

HUD approved Housing Counseling Agencies, a list that our dad won't look at.

HUD Guide to Avoiding Foreclosure, a web site that our dad refuses to read.

HOPE NOW is an alliance between HUD approved counseling agents, servicers, investors and other mortgage market participants that provides free foreclosure prevention assistance. 888-995-HOPE (24 hour hotline). Yet another place that of course our dad won't call.

It's amazing that there IS so much help out there. I hope you, gentle readers, never need such help. But if you do, please pick up the phone and ask for help, OK?

Sunday, November 9, 2008

Saturday, October 18, 2008

auction for mom - dealing with mom comic zine

Bid by clicking here: dealing with mom comic zine, hand embellished - eBay (item 280278116792 end time Oct-25-08 14:54:34 PDT)

dealing with mom

a comic zine by Kerrie Carbary

Dealing with Mom is a 24 page hand drawing comic zine all about the adventures of dealing with my mother's health issues, illness and related adventures, including an appearance by the great and powerful Dr. Neurontin, Scott wearing a cape, and an illustration of the plates, saucers, and cups that they wanted to insert in my mom's spine.

5.5 x 8.5 inches, black and white, staple bound and photocopied.

This copy is a one of a kind hand embellished version of dealing with mom. Each page is either hand colored, embellished, or otherwise altered to create a collectible edition of one!

All profits after selling fees will be added to the mom fund. :)

dealing with mom

a comic zine by Kerrie Carbary

Dealing with Mom is a 24 page hand drawing comic zine all about the adventures of dealing with my mother's health issues, illness and related adventures, including an appearance by the great and powerful Dr. Neurontin, Scott wearing a cape, and an illustration of the plates, saucers, and cups that they wanted to insert in my mom's spine.

5.5 x 8.5 inches, black and white, staple bound and photocopied.

This copy is a one of a kind hand embellished version of dealing with mom. Each page is either hand colored, embellished, or otherwise altered to create a collectible edition of one!

All profits after selling fees will be added to the mom fund. :)

Monday, October 13, 2008

help mom by reading

If you shop from Powell's through these links (even if you don't buy THESE books), 7.5% of your order will go to the mom fund!

The Bean Trees by Barbara Kingsolver

The Canterbury Tales by Chaucer

Staying Well in a Toxic World (understanding environmental illness, multiple chemical sensitivities, chemical injuries, and sick building syndrome) by Lynn Lawson

Bodies in Protest: Environmental Illness and the Struggle Over Medical Knowledge by Steven Kroll

Silver Dental Fillings: The Toxic Timebomb: Can the Mercury in Your Dental Fillings Poison You? by Sam Ziff

Mercury Free: The Wisdom Behind the Global Consumer Movement to Ban Silver Dental Fillings by James Earl Hardy

Canary in the Courtroom: How Pesticide Poisoning Changed a Woman's Life and Forced Her Into Civil Action by Jessie Macleod

I'll Hold Your Hand So You Won't Fall: A Child's Guide to Parkinson's Disease by Rasheda Ali

Lumbar Spinal Stenosis by Robert Gunzburg

The Bean Trees by Barbara Kingsolver

The Canterbury Tales by Chaucer

Staying Well in a Toxic World (understanding environmental illness, multiple chemical sensitivities, chemical injuries, and sick building syndrome) by Lynn Lawson

Bodies in Protest: Environmental Illness and the Struggle Over Medical Knowledge by Steven Kroll

Silver Dental Fillings: The Toxic Timebomb: Can the Mercury in Your Dental Fillings Poison You? by Sam Ziff

Mercury Free: The Wisdom Behind the Global Consumer Movement to Ban Silver Dental Fillings by James Earl Hardy

Canary in the Courtroom: How Pesticide Poisoning Changed a Woman's Life and Forced Her Into Civil Action by Jessie Macleod

I'll Hold Your Hand So You Won't Fall: A Child's Guide to Parkinson's Disease by Rasheda Ali

Lumbar Spinal Stenosis by Robert Gunzburg

Sunday, October 12, 2008

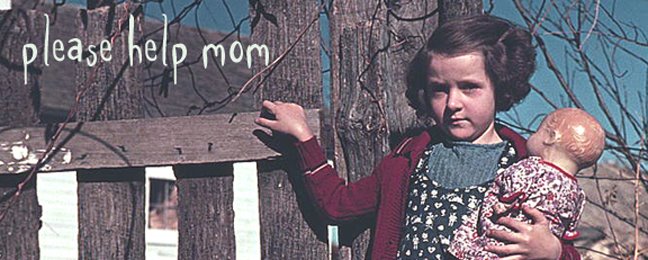

Hello. Our Mom needs help.

Hello! We're starting this blog because our mom needs help, and we don't know where to turn. We are three sisters who are trying to save our disabled, chronically ill mother from a bad situation.

A few years back, our mom was diagnosed with Parkinson's disease. Since, she's been undiagnosed, rediagnosed, and now they are saying that she has "Parkinson's-Like Syndrome." Whatever that means! She also has severe spinal problems, and has had a failed spinal fusion which leaves her unable to work, unable to jump up and do the things she's always done, and unable to save herself when life turns against her. She's also been chemically poisoned by pesticides and mercury. So we've been taking care of her as best we can.

One of us lives across the country.

One of us lives in another city.

One of us lives across town.

All of us love our mom very much and want what's best for her.

In the past year, it's become more and more difficult for her to take care of herself and for us to fill in the gaps. Her husband, our dad, doesn't help her, even though they live together. Sometimes she calls from her bed and he either ignores her, or he yells angrily at her. He is dealing with his own issues; he's been unemployed and feels overwhelmed and burnt out. At any rate, he can't be depended on much.

We wish that we could take her out of that situation, but financially, she is dependent on him, and none of us are able to take on the role of taking care of her financially. She wants to stay in her own home, and we've been trying our hardest to keep that a reality for her.

As time has gone on, she's needed more and more care. Caregivers are expensive. As a result, other bills have been neglected.

Mom is now being faced with foreclosure on her home. The caregiving agency is threatening to stop sending caregivers. She needs more care than is available from volunteer sources and from her family.

What should we do?

We're starting this blog to talk about it, and also to use to put our ideas out there for fund raising. We'll be selling things to make some cash to help mom out, and we'll be gathering resources that might be useful to others in similar situations.

Thank you for visiting and considering helping our mom!

The 3 Sisters

A few years back, our mom was diagnosed with Parkinson's disease. Since, she's been undiagnosed, rediagnosed, and now they are saying that she has "Parkinson's-Like Syndrome." Whatever that means! She also has severe spinal problems, and has had a failed spinal fusion which leaves her unable to work, unable to jump up and do the things she's always done, and unable to save herself when life turns against her. She's also been chemically poisoned by pesticides and mercury. So we've been taking care of her as best we can.

One of us lives across the country.

One of us lives in another city.

One of us lives across town.

All of us love our mom very much and want what's best for her.

In the past year, it's become more and more difficult for her to take care of herself and for us to fill in the gaps. Her husband, our dad, doesn't help her, even though they live together. Sometimes she calls from her bed and he either ignores her, or he yells angrily at her. He is dealing with his own issues; he's been unemployed and feels overwhelmed and burnt out. At any rate, he can't be depended on much.

We wish that we could take her out of that situation, but financially, she is dependent on him, and none of us are able to take on the role of taking care of her financially. She wants to stay in her own home, and we've been trying our hardest to keep that a reality for her.

As time has gone on, she's needed more and more care. Caregivers are expensive. As a result, other bills have been neglected.

Mom is now being faced with foreclosure on her home. The caregiving agency is threatening to stop sending caregivers. She needs more care than is available from volunteer sources and from her family.

What should we do?

We're starting this blog to talk about it, and also to use to put our ideas out there for fund raising. We'll be selling things to make some cash to help mom out, and we'll be gathering resources that might be useful to others in similar situations.

Thank you for visiting and considering helping our mom!

The 3 Sisters

Saturday, October 11, 2008

thank you

Thank you to the anonymous poster who let me know about sites to post our story. I've put a link to this blog on:

digitalcharity.com

realitycharity.com

(I've backdated this post so that the story stays at the top.)

digitalcharity.com

realitycharity.com

(I've backdated this post so that the story stays at the top.)

Subscribe to:

Posts (Atom)

2.jpg)